As of January 31, 2023, the arm brace rule (2021R-08F) has been published in the Federal Register. and therefore, has the force and effect of law (unless overturned in the future by a legal challenge).

As of January 31, 2023, the arm brace rule (2021R-08F) has been published in the Federal Register. and therefore, has the force and effect of law (unless overturned in the future by a legal challenge).

If you own an arm brace equipped pistol (shotguns and non-pistols are not covered under this rule) which is subject to the rule (see the ATF example document here), you have some decisions to make.

The first decision is whether or not to comply. There are numerous people online who are stating that they simply will not comply.

As an attorney, I cannot advise you to break or ignore the law. My advice to my clients is to follow one of the compliance options the ATF has laid out in their FAQ while awaiting the results of the multiple legal challenges that are being mounted against the rule.

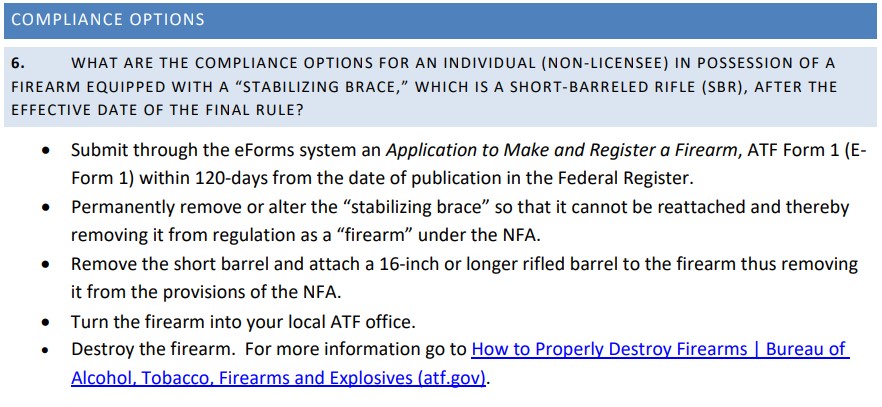

As laid out above, the options are:

1) Register the arm brace equipped pistol during the 120 day amnesty period to get a free SBR tax stamp.

2) Remove the arm brace from the pistol and either destroy it or remove it from the premises completely (the details of constructive possession are beyond the scope of this article). This would remove the pistol from the purview of the rule since it is no longer equipped with an arm-brace.

3) Add a 16+ inch barrel to the pistol thereby removing it from the provisions of the NFA regardless of whether it has an arm brace on it.

The other two options, to surrender or destroy the pistol itself, are beyond stupid and deserve no more consideration.

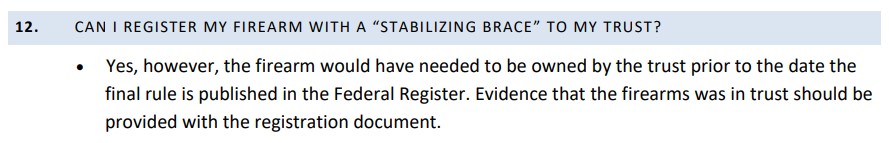

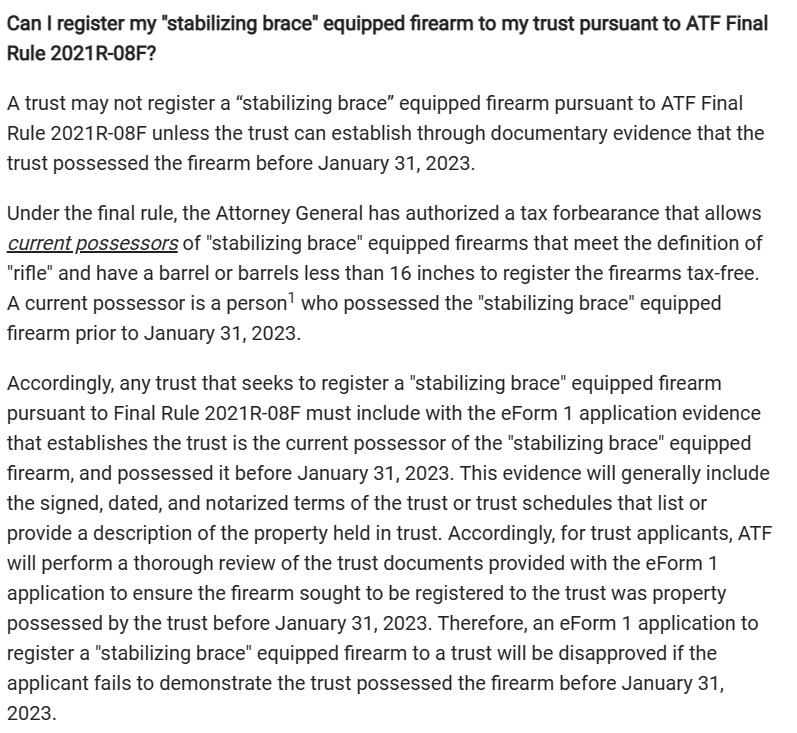

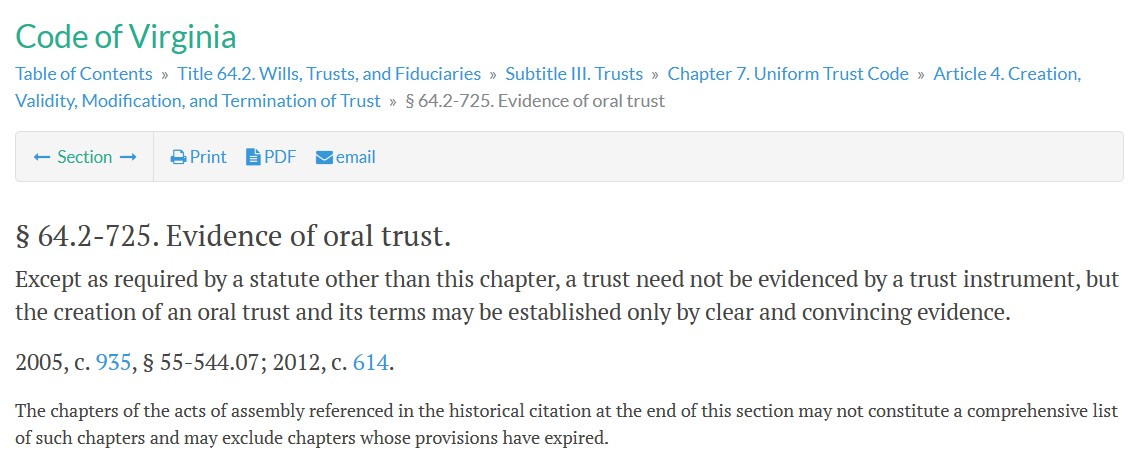

If you have one of my NFA Trusts and wish to use the trust to apply for the free amnesty tax stamp, you need to document the fact that you assigned the arm brace equipped pistol to your trust prior to the date the rule was published. This documentation is then uploaded during the eForm1 process.

As of today the arm brace rule (2021R-08F) is in the

As of today the arm brace rule (2021R-08F) is in the  UPDATE:

UPDATE: