During one of the virtual training sessions the ATF held earlier this week, one of the presenters made a statement that I think bears repeating. While it isn’t 100% perfect, I think it can help eliminate some of the misunderstandings that are rampant in the community right now.

During one of the virtual training sessions the ATF held earlier this week, one of the presenters made a statement that I think bears repeating. While it isn’t 100% perfect, I think it can help eliminate some of the misunderstandings that are rampant in the community right now.

What he said was effectively this (paraphrased since I don’t have a word for word transcript):

“The easiest way to understand the arm brace rule is to assume that all we have done is to declare arm braces to be butt stocks but with an amnesty period to come into compliance.”

That really does a good job of framing the issue and answering the questions that keep coming up. For example:

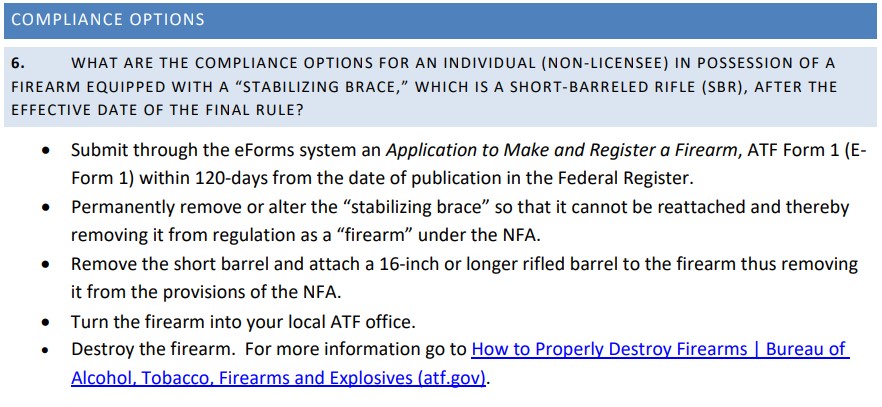

Q: What if I don’t want to register my pistol as an SBR?

A: Then take off the “butt stock” and return it to pistol configuration before the end of the amnesty period.

Q: If I return it to pistol status, does this affect the type of buffer tube I can have on my pistol?

A: No it does not. Once the ‘butt stock’ is removed, you have a non-nfa pistol. It doesn’t matter whether the pistol has a buffer tube that could possibly accept a ‘butt stock’ any more than it matters that a pistol has a rail which gives it the ability to accept a vertical foregrip. So long as the ‘butt stock’ is not equipped and not in a proximity that could give rise to claims of ‘constructive possession’, then it simply doesn’t matter.

Q: What do I do with the “butt stock”?

A: Keep it as an extra for a registered SBR, sell it, discard it, or destroy it. But if keeping it, make sure your continued possession could not be construed as ‘constructive possession’.

Q: Can dealers still sell “butt stocks”?

A: Of course they can. They are just accessories, and the ATF does not regulate accessories. You just can’t use them to assemble an unregistered SBR from an AR pistol.

I will add more examples here as they occur to me. But, as you are thinking about your questions, try to ask them by replacing ‘arm brace’ with ‘butt stock’ and see if the question doesn’t suddenly resolve itself.

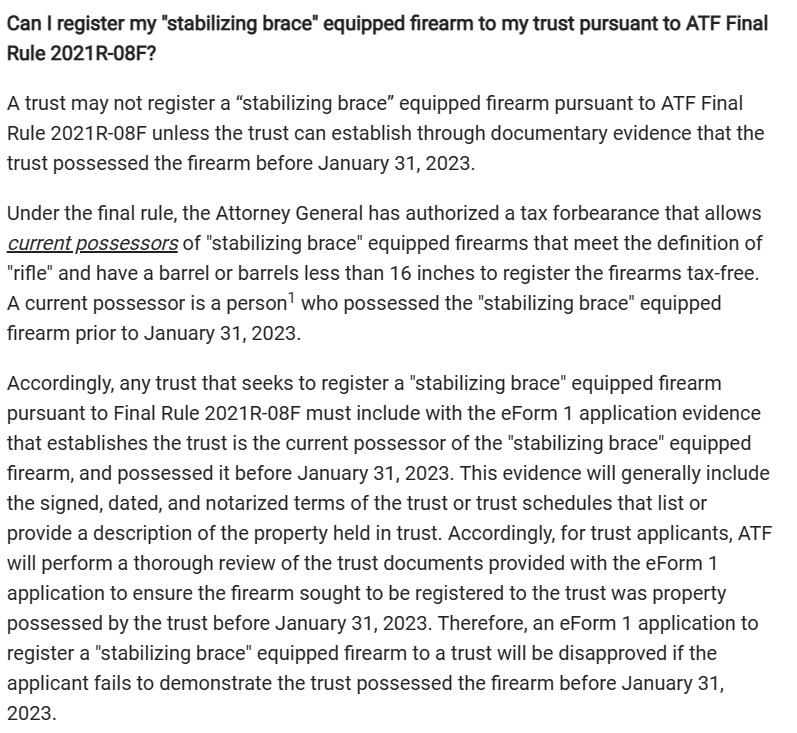

As of January 31, 2023, the arm brace rule (2021R-08F) has been

As of January 31, 2023, the arm brace rule (2021R-08F) has been