This guide will walk you through every step of the process to do a private transfer of individually owned or trust owned NFA items to your NFA Trust and make it as easy as possible. The fields referenced are based upon the December 2025 revision of the Form 4. As new revisions of the form are released, I will update this guide.

Getting Started

The Form 4 is available for download from the ATF website. You should save it to your computer and open it with Adobe Reader or your preferred PDF editor on your computer (rather than editing it in your browser or on a phone or tablet where the built in automations will NOT work correctly) then it will auto-copy the data you type into the ‘ATF Copy’ to the ‘Registrant Copy’ and the ‘CLEO Copy’.

Form 4 – Page 1

- Box 1 will be checked for $0 unless you are transferring a machinegun or destructive device. The changes that took place in 2025 and went into effect on January 1, 2026 from the Big Beautiful Bill removed the excise tax on all other NFA items.

- Box 2 should contain the name of your trust (exactly as it appears on the header of the trust document) and the mailing address for the location where the item will initially be stored.

- In Box 2 you should also check the box for TRUST.

- Box 3a should contain the name of the current registrant (exactly as it appears on the current tax stamp) and the owner’s current mailing address.

- Box 3b should contain the owner’s email address.

- Box 3c should contain owner’s telephone number.

- Box 3d and 3e should usually be left blank (if there is a decedent involved then a Form 5 might need to be completed and you should call me to discuss).

- Boxes 4a through 4h should be copied directly from the current tax stamp.

- Unless the registrant has an FFL listed on the original tax stamp (very rare), then boxes 5, 6, 7, and 8 should be left blank.

- Sign your name in Box 9. Important: The ATF requires all signatures to be in either blue or black ink.

- Box 10 should contain the current registrant’s name (as it appears on the current tax stamp) followed by “- SELF” if owned individually or “-TRUSTEE” if currently owned in a trust.

- Box 11 should contain the current date.

Form 4 – Page 2

- Box 12 should contain the information about your CLEO.

- Box 13 should have the name of your trust in the first blank and ‘all lawful purposes‘ in the second blank.

- Box 14, 15, 16, 17, 18 and 19 should be left blank. For trust applicants, these background questions and photos will be part of a separate form for each ‘responsible person’ (Form 23) for which I will provide instructions further down in this guide.

- On the bottom of Page 2 sign your name and add “as trustee” at the end then enter the date in the accompanying field. Important: The ATF requires all signatures to be in either blue or black ink.

Form 4 – Page 3

- Box 20 should contain the number of responsible persons on your trust. I have a detailed article here laying out which persons on your trust are considered ‘responsible persons’ but the short answer is that you are a responsible person and so are those people listed on Schedule B of your trust. If you want to remove joint trustees from your Schedule B before submitting your application, I have a guide to doing so here.

- Box 21 should contain your full legal name and the full legal names of all those on Schedule B of your trust.

- Box 22 should contain your method of payment and, if you are paying with a credit card, the information about the credit card and the amount being paid. You only need to sign in Box 20 if you are paying with a credit card. Important: The ATF requires all signatures to be in either blue or black ink.

Turning to the Form 23

A copy of the new ‘responsible person’ form 5320.23 (Form 23) will need to be completed by each ‘responsible person’ of the trust listed in Box 21 of the Form 4.

Important Note: Your fellow ‘responsible persons’ will find it much easier to complete this form if they have a copy of the completed Form 4 in front of them.

The Form 23 may be downloaded from the ATF website. It is well designed with fillable fields which auto-transfer the data to additional copies (this only works if you use a PDF editor on your computer instead of on your browser, phone, or tablet). I will instruct you where to send each copy later in this guide.

You, and any Joint Trustees listed on Schedule B of your trust, should download the form and each one must complete it according to the following instructions:

Form 23 – Page 1

- In Box 1 you should check the box for Form 4.

- In Box 2 you should copy the trust name and address from Box 2 on the Form 4.

- In Box 3a you should put your full legal name and your home address.

- In Box 3b you should put your telephone number.

- In Box 3c you should put your email address.

- If you have changed your name at any time during your life, including being married, then Box 3d should contain all other names you have ever used.

- In Box 3e you will affix a 2×2 passport-quality photo taken within the last year (on the ATF copy of the form only). As I noted here, many NFA dealers offer in-store photography options so you should check with your local gun store. Failing that, Walgreens is a common provider of this service in many towns.

- Box 3f should contain your Social Security Number. This is an optional field but including it should dramatically decrease your processing time.

- Box 3g should also contain your date of birth.

- Box 3h should contain your ethnicity

- Box 3i should contain your race

- In Box 4a, you should copy the type-of-firearm from the Form 4

- In Box 4b you should copy the mfg/maker/importer name and address from the Form 4

- In Box 4c you should copy the model from the Form 4

- In Box 4d you should copy the caliber and UOM from the Form 4

- In Box 4e you should copy the serial number from the Form 4

- Box 5 should contain the information regarding the CLEO whose jurisdiction includes the home address in Box 3a of this form.

Form 23 – Page 2

- You will need to answer the questions in Boxes 6, 7, 8, and 9 as they apply to you, the person completing the form. You will need to answer them truthfully as any errors may be prosecuted as perjury!

- Note: If you have been convicted of a felony but have since had your gun rights restored then the instructions state you should answer question ‘No’ to the question about whether you have been convicted of a felony. However, I strongly advise you to attach a copy of your restoration paperwork to the Form 23 when submitting it to the ATF.

- You will sign the certification following Box 9. (More about this in the signing section below)

- You should enter the date in the field to the right of the signature block.

Printing The Completed Form 23

Once you have completed the Form 23, you will need to print it. It will print 2 copies. You should now affix your photo to the ATF copy of the Form 23 only. (DO NOT USE STAPLES)

Signing the Completed Form 23

The only place you will need to sign the Form 23 is following the certification statement below Box 9. You do NOT add “as trustee” to your signature on this form.

Do not forget to sign both copies of the Form 23.

Important: The ATF requires all signatures to be in either blue or black ink.

Notifying Your CLEO

The Settlor of the trust will need to mail his or her CLEO (From Box 5 of the Form 23) the CLEO copy of the Form 4 and the CLEO copy of their Form 23.

All other responsible persons (in the rare event you have them) will only need to mail his or her CLEO (From Box 5 of their Form 23) the CLEO copy of their Form 23.

Important Note: The CLEO copy of the Form 23 does not have a photo affixed. You should also not send fingerprint cards to the CLEO.

Fingerprint Cards

Each Form 23 to be sent to the ATF will need to be accompanied by fingerprints of the responsible person taken on TWO FBI (FD-258) fingerprint cards. As I noted here, many NFA dealers offer in-store fingerprinting so you should check with your local gun store. Failing that, you should be able to get fingerprinted at your local law enforcement agency. No matter who does the fingerprinting, you should make sure that they use the correct FD-258 cards.

Mailing the Completed Form 4 Packet to the ATF

Now we need to prepare the packet to mail to the ATF. Note that If you are building more than one NFA item, you will need a separate packet for each item.

This packet should include:

- The first 2 copies of the completed Form 4 with original signatures in blue or black ink on both copies. (These are marked ATF Copy and Registrant Copy on the bottom of the forms)

- The ATF Copy of the Form 23 for each responsible person of the trust (in the rare event you have them) with photos affixed and fingerprint cards included. (DO NOT STAPLE)

- A single copy of your notarized trust instrument (including all schedules and amendments)

- Payment for the amount of the tax ($200) (if machinegun or destructive device) payable to BATFE (unless you entered credit card info on the Form 4)

The entire packet should be mailed to:

National Firearms Act Division

Bureau of ATF

PO Box 5015

Portland, OR 97208-5015

If this guide leaves any questions unanswered, please feel free to contact me.

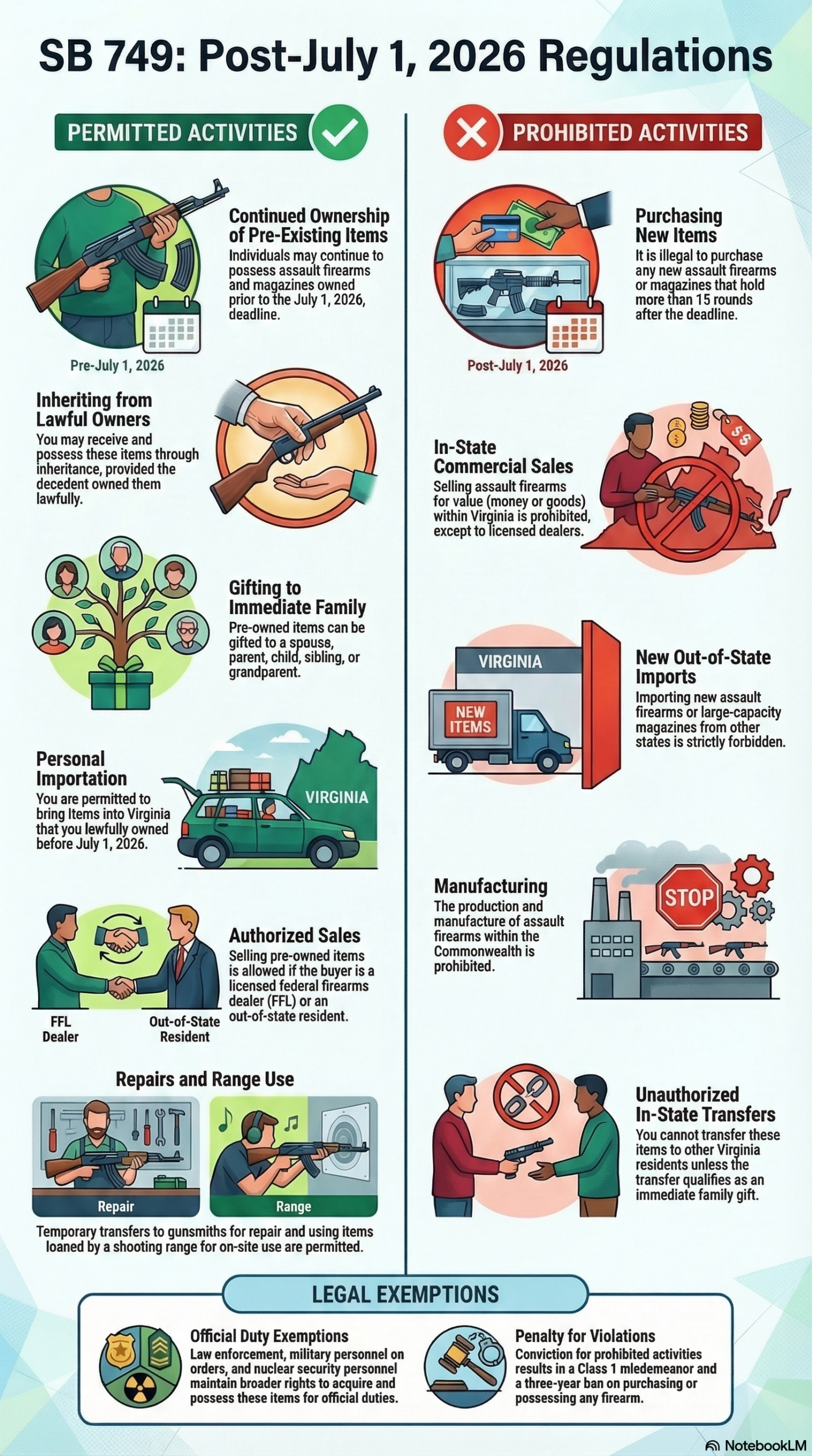

The anti-civil rights bills are flooding in and both gun owners and the firearms industry are facing unprecedented attacks in Virginia.

The anti-civil rights bills are flooding in and both gun owners and the firearms industry are facing unprecedented attacks in Virginia.

As of the latest January 2026 updates, eForms now allows Form 4 transfers in addition to those that are initiated by a sale at an FFL. These transfers include:

As of the latest January 2026 updates, eForms now allows Form 4 transfers in addition to those that are initiated by a sale at an FFL. These transfers include: