Another question that has arisen since Monday’s holding in Abramski v. United States is whether the rules governing the acquisition of firearms for raffles were affected by the decision.

Another question that has arisen since Monday’s holding in Abramski v. United States is whether the rules governing the acquisition of firearms for raffles were affected by the decision.

The short answer is no. But there remains a great deal of confusion as to how raffles should be handled. The ATF addresses the question in detail on their Frequently Asked Questions page.

Q: An organization without a firearms license wishes to acquire a firearm from a licensee for the purpose of raffling the firearm at an event. How does the licensee comply with the Brady law?

The licensee must comply with the Brady law by conducting a NICS check on the transferee. If the licensee wishes to transfer the firearm to the organization, a representative of the organization must complete a Form 4473, and a NICS check must be conducted on that representative prior to the transfer of the firearm. Alternatively, if the licensee transfers the firearm directly to the winner of the raffle, the winner must complete a Form 4473, and a NICS check must be conducted on the raffle winner prior to the transfer.

Please note, if the organization’s practice of raffling firearms rises to the level of being engaged in the business of dealing in firearms, the organization must get its own Federal firearms license (and the examples below would not apply).

Example 1: A licensee transfers a firearm to the organization sponsoring the raffle. The licensee must comply with the Brady Law by requiring a representative of the organization to complete the Form 4473 and undergo a NICS check. As indicated in the instructions on the Form 4473, when the buyer of a firearm is a corporation, association, or other organization, an officer or other representative authorized to act on behalf of the organization must complete the form with his or her personal information and attach a written statement, executed under penalties of perjury, stating that the firearm is being acquired for the use of the organization and the name and address of the organization. Once the firearm had been transferred to the organization, the organization can subsequently transfer the firearm to the raffle winner without a Form 4473 being completed or a NICS check being conducted. This is because the organization is not an FFL. However, the organization cannot transfer the firearm to a person who is not a resident of the State where the raffle occurs and cannot knowingly transfer the firearm to a prohibited person.

Example 2: The licensee or his or her representative brings a firearm to the raffle so that the firearm can be displayed. After the raffle, the firearm is returned to the licensee’s premises. The licensee must complete a Form 4473 for the transaction and must comply with the Brady Law prior to transferring the firearm to the winner of the raffle. If the firearm is a handgun, the winner of the raffle must be a resident of the State where the transfer takes place, or the firearm must be transferred through another FFL in the winner’s State of residence. If the firearm is a rifle or shotgun, the FFL can lawfully transfer the firearm to the winner of the raffle as long as the transaction is over-the-counter and complies with the laws applicable at the place of sale and the State where the transferee resides.

Example 3: If the raffle meets the definition of an “event” at which the licensee is allowed to conduct business pursuant to 27 CFR 478.100, the licensee may attend the event and transfer the firearm at the event to the winner of the raffle. As in Example 2, the FFL must complete a Form 4473 and comply with the Brady law and the interstate controls in transferring the firearm.

Please note, procedures used in Examples 2 and 3 ensure that the winner is not a prohibited person and that there is a record of the final recipient of the firearm in the raffle.

[18 U.S.C. 922(t) and 922(a)(1)(A)]

Another scenario I have heard described involves a variation on Example 1 above in which a representative of the organization acquires the firearm on behalf of the organization but returns it to the dealer at the end of the raffle with the winner also being required to complete a 4473 and undergo a background check. While the ATF does not address this scenario, I do not believe that it would run afoul of either current policy or the relatively narrow holding in Ambramski.

Having said all of that, organizations holding raffles should keep an eye on the ATF’s position in this regard. As Andrew Branca noted in his review of the Abramski decision over at Legal Insurrection:

[Scalia in his dissent] noted that the ATF itself did not adopt the “straw purchase” position until 1976, fully 8 years after the passage of the 1968 Gun Control Act, at which time it changed to favor the “straw purchase” purchases are illegal position. (NOTE: This would seem to have implications for the currently existing “gifts” and “raffle prizes” exceptions, as it would seem that the ATF could as easily eliminate those by a mere shift in policy.)

Organizations should also keep in mind that these examples are only based upon federal law and states may have transfer requirements that are more stringent than federal law.

If you have a question about how to conduct firearms raffles in your state, you should consult with an attorney licensed to practice law in your state who is familiar with the appropriate transfer laws.

Yesterday the United States Supreme Court handed down a 5-to-4 ruling in the case of

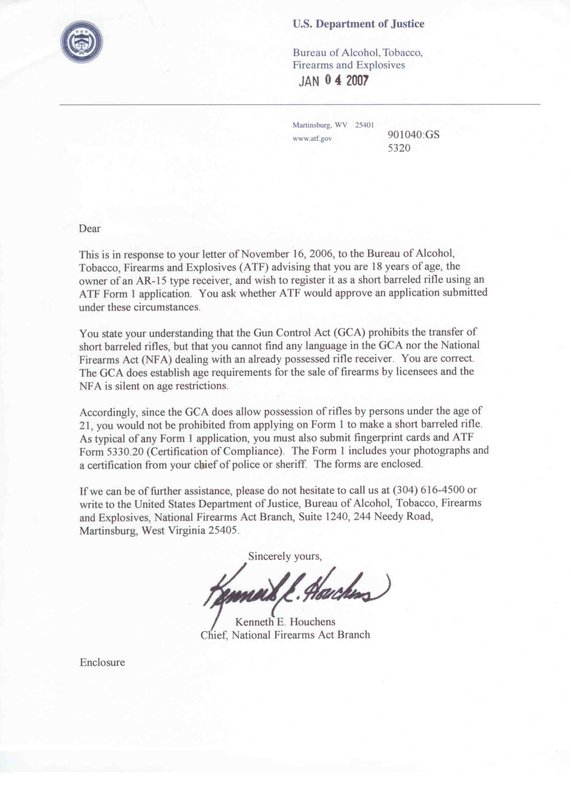

Yesterday the United States Supreme Court handed down a 5-to-4 ruling in the case of  I was recently contacted by a client who was considering purchasing a threaded ‘solvent trap’ adapter and using it as the basis for a Form 1 build of a suppressor.

I was recently contacted by a client who was considering purchasing a threaded ‘solvent trap’ adapter and using it as the basis for a Form 1 build of a suppressor.

This is a question that seems to arise at least once a week as I am speaking with clients and I think it would be beneficial to do a complete breakdown of the topic.

This is a question that seems to arise at least once a week as I am speaking with clients and I think it would be beneficial to do a complete breakdown of the topic.

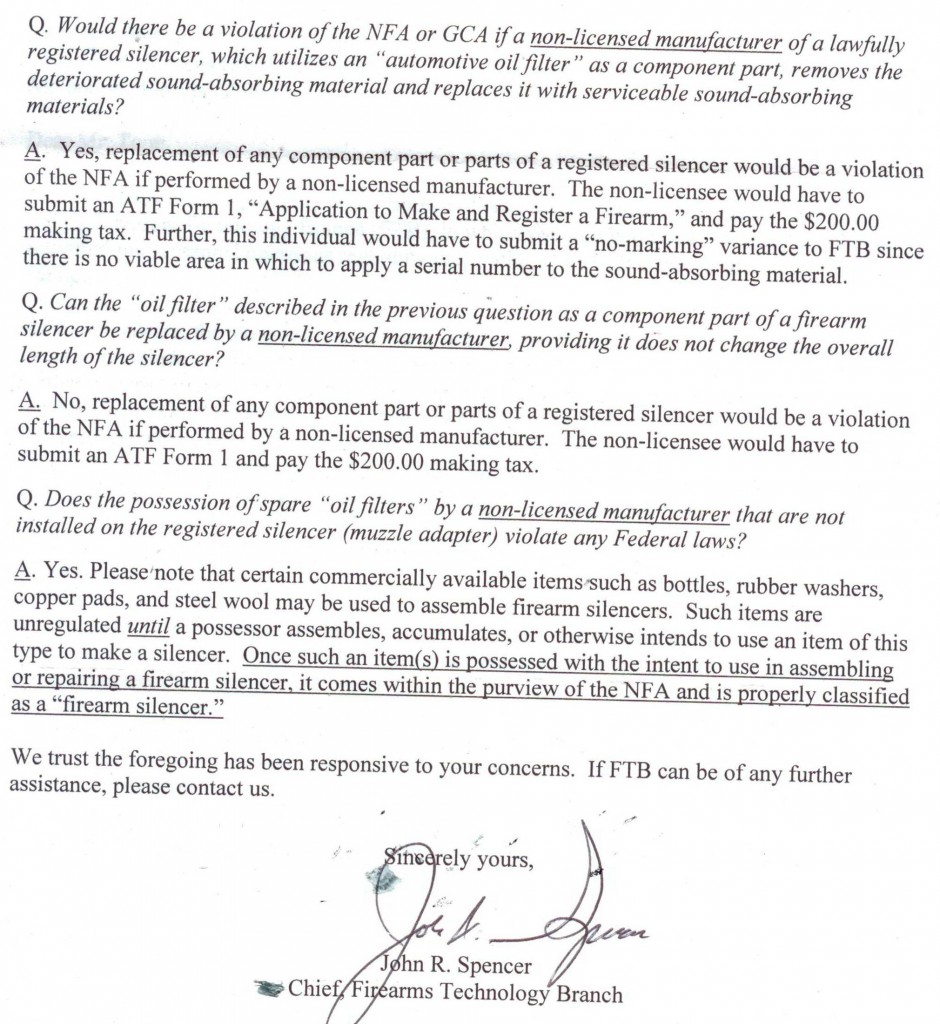

This is a question that was recently asked by one of my client. The answer, as with most issues involving the NFA and ATF regulations, requires a slightly detailed answer.

This is a question that was recently asked by one of my client. The answer, as with most issues involving the NFA and ATF regulations, requires a slightly detailed answer.