UPDATED JANUARY 2023 TO ACCOUNT FOR UPDATED LANGUAGE IN THE 4473 AND SP-65

UPDATED JANUARY 2023 TO ACCOUNT FOR UPDATED LANGUAGE IN THE 4473 AND SP-65

In Virginia, there are a number of mental health adjudications that can lead to a prohibition on the right to purchase, possess, and transport firearms.

These include the following:

- Persons acquitted of a crime by reason of insanity

- Persons adjudicated legally incompetent or mentally incapacitated

- Persons involuntarily admitted or ordered to outpatient treatment

- Persons subject to a temporary detention order who subsequently agreed to voluntary commitment

All four categories allow for a person thus impacted to petition the General District Court in the jurisdiction where they reside for restoration of their gun rights after they have recovered from the issue which gave rise to the adjudication.

If you have had your gun rights restored following one of the aforementioned mental health adjudications then you are able to once again legally purchase firearms, both in private transactions and from a licensed dealer.

However, there is a question on the ATF Form 4473 (2023 version linked) which you must answer correctly or your purchase will be denied.

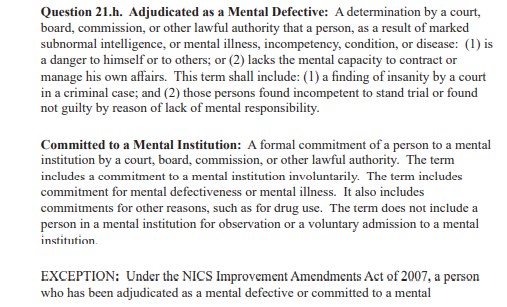

When completing this form, question 21h (in the 2023 version of the 4473) asks about mental health prohibitors.

![]()

Your initial inclination would be to answer ‘Yes’ since this is truthful answer to the question presented. But that is not what you should do.

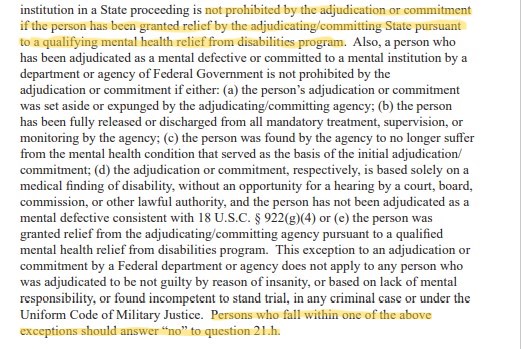

The header of the form instructs applicants to see the attached instructions for each question. There we find that there are exceptions to this question.

Under the NICS Improvement Act of 2007, when a state court grants a qualified relief petition, the adjudication or commitment that rendered the person ineligible to possess or acquire firearms is “deemed not to have occurred” for purposes of federal law (see § 105(b) of the NICS Improvement Act of 2007)

A person who has had his or her firearm rights restored by a qualified state process may answer ‘No’ to question 11f on the ATF form 4473 when applying to purchase a firearm.

However, to insure that there could never be a question about the honesty or intent of the applicant, I advise my clients to answer the question ‘No‘ and then put ‘Rights Restored‘ in the margin beside the question.

IMPORTANT NOTE: When completing the form 4473, the Social Security Number (SSN) field is optional, and many people choose to not provide it as a matter of principle. In your case, to make sure they are matching your application to the record showing your restoration, I strongly recommend that you provide your SSN.

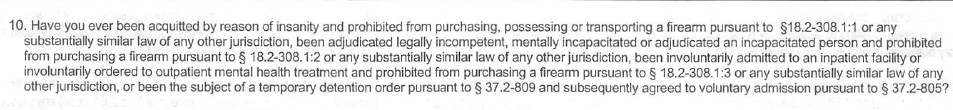

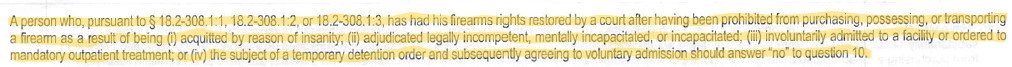

In Virginia, there is also a state form (SP65) which you will have to complete in addition to the ATF form 4473. Question 10 on the state form asks a similar question:

… and has a similar exception.

So you would answer this question ‘No’ as well if your rights have been restored pursuant to one of the code sections mentioned in the exception.

Even with your rights restored, you should know that you may be delayed when attempting to make a purchase. In case there is ever any question, I would also strongly suggest carrying a copy of the restoration order with you both when you apply for, and when picking up, the firearm.

Finally, I want to reiterate that, while this restoration removes both your federal and Virginia disabilities, it does not necessarily remove the prohibitions in any other state. Before possessing a firearm in any state other than Virginia you should consult with an attorney licensed to practice law in that state to determine whether that state has a prohibition that would apply to your situation, whether that state recognizes gun rights restoration proceedings from other states and, if so, whether Virginia’s process meets their requirements.

Disclaimer: This information is presented for educational purposes only and does not give rise to an attorney-client relationship. Additionally, I am licensed to practice law in the Commonwealth of Virginia and this answer is specific to Virginia.

Because of the imperfect intersection of local, state, and federal laws, there are a number of legal questions that arise when a felon has their gun rights restored.

Because of the imperfect intersection of local, state, and federal laws, there are a number of legal questions that arise when a felon has their gun rights restored.

“What can I do to my trust to reduce the number of people who need to be fingerprinted and photographed?”

“What can I do to my trust to reduce the number of people who need to be fingerprinted and photographed?” “Just who are these ‘responsible persons’ the ATF keeps talking about?”

“Just who are these ‘responsible persons’ the ATF keeps talking about?”