The vast majority of my clients own their NFA items in an NFA Trust so that they get the dual benefits of sharing the items while they are alive and probate-avoidance when they pass away. However, I occasionally get a call from a potential client who is the Executor of an estate which contains individually-owned NFA items.

You may be asking yourself, “What exactly is an Executor?” When I use the term ‘Executor’, I am referring to that position which some states call ‘executor’, ‘administrator’, or ‘personal representative’. Regardless of the term used in a given state, it is the “person authorized under State law to dispose of property in an estate.”

The question of whether or not an Executor should sell the items or transfer them to a beneficiary or an heir is based upon the Will of the deceased owner (or lack thereof). However, in the case where the Executor has determined that they need to sell an item, the question then arises as to how to complete the Form 4. I will do a separate article in the future on how to complete a Form 5 for transfer of an NFA item to a beneficiary or heir.

But before we talk about completing the Form 4, there is a threshold question that must be answered. Has the Executor been able to locate the approved tax stamp documents for the NFA items? If they have then they can move on to the procedural steps below. However, if they have not then they need to ascertain whether or not the items are properly registered in the National Firearms Registration and Transfer Record (NFRTR). In the ATF NFA Handbook, they have this to say:

If the executor or administrator cannot locate the decedent’s registration documents, he/she should contact the NFA Branch in writing and inquire about the firearms’ registration status. This inquiry should be accompanied by documents showing the executor’s or administrator’s authority under State law to represent the decedent and dispose of the decedent’s firearms. Although ATF is generally prohibited from disclosing tax information, including the identity of persons to whom NFA firearms are registered, ATF may disclose such information to persons lawfully representing registrants of NFA firearms.

If you find yourself in such a situation, I will be glad to assist you in preparing an appropriate letter to the ATF. I will do a separate article in the future on how to lawfully dispose of NFA items that are deemed to not be properly registered, and therefore contraband.

But for purposes of this article, we will assume the proper documents have been found. Having determined that the NFA items are properly registered in the NFRTR, the ATF allows an Executor “a reasonable time” to submit either a Form 4 or a Form 5 for the NFA items in question. While they do not specifically define this term in the NFA Handbook, you will note that the controlling regulation (quoted below) states that this is “[n]o later than the close of probate.”

It is also important to note that the Executor is subject to the same limitations as an individual owner. For example, if the item is being sold to a resident of another state, then the item must be transferred to a properly licensed dealer in that state and then transferred from that dealer to the buyer. I should add that I am licensed to practice law in the Commonwealth of Virginia and your state may have even more state-level requirements that must be observed.

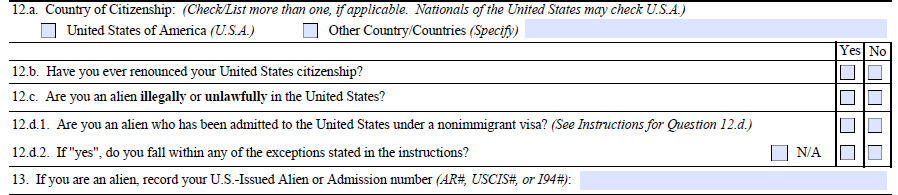

Now that we have all of that out of the way, the executor should fill-in the following fields on the Form 4:

- Box 3a should contain the name and address of the qualified Executor or Personal Representative (Per ATF guidance March 2020)

- Boxes 3b and 3c should contain the Executor’s email and telephone number

- Box 3d should contain the name, address, and date of death of the individual owner

- Boxes 4a through 4h should match the corresponding fields on the approved tax stamp document for the item (Note that the ATF has been trying to correct historic errors in the NFRTR and so may ask you to change any information that is determined to be incorrect even if that is the way it is written on the original approved tax stamp)

- Note that these instructions assume that the individual owner did not hold an FFL. If they did hold an FFL, contact me for more specific advice tailored to your situation

- The executor should sign in Box 9

- The Executor should print their name in Box 10 and then note their title of Executor (or whatever the appropriate term is under the laws of their state)

- Finally, the Executor should enter the date that they signed the Form 4 in Box 11

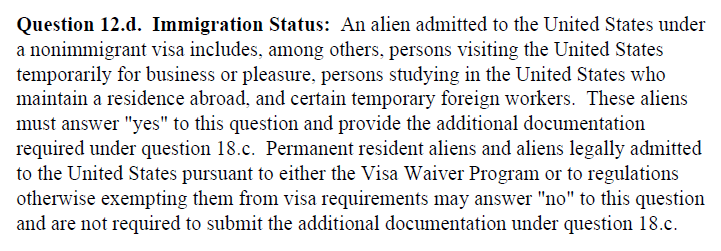

As for what documentation the Executor should send along with the Form 4, this entire process is governed by 27 CFR § 479.90a, which states that (emphasis added):

(a) The executor, administrator, personal representative, or other person authorized under State law to dispose of property in an estate (collectively “executor”) may possess a firearm registered to a decedent during the term of probate without such possession being treated as a “transfer” as defined in § 479.11. No later than the close of probate, the executor must submit an application to transfer the firearm to beneficiaries or other transferees in accordance with this section. If the transfer is to a beneficiary, the executor shall file an ATF Form 5 (5320.5), Application for Tax Exempt Transfer and Registration of Firearm, to register a firearm to any beneficiary of an estate in accordance with § 479.90. The executor will identify the estate as the transferor, and will sign the form on behalf of the decedent, showing the executor’s title (e.g., executor, administrator, personal representative, etc.) and the date of filing. The executor must also provide the documentation prescribed in paragraph (c) of this section.

(b) If there are no beneficiaries of the estate or the beneficiaries do not wish to possess the registered firearm, the executor will dispose of the property outside the estate (i.e., to a non-beneficiary). The executor shall file an ATF Form 4 (5320.4), Application for Tax Paid Transfer and Registration of Firearm, in accordance with § 479.84. The executor, administrator, personal representative, or other authorized person must also provide documentation prescribed in paragraph (c) of this section.

(c) The executor, administrator, personal representative, or other person authorized under State law to dispose of property in an estate shall submit with the transfer application documentation of the person’s appointment as executor, administrator, personal representative, or as an authorized person, a copy of the decedent’s death certificate, a copy of the will (if any), any other evidence of the person’s authority to dispose of property, and any other document relating to, or affecting the disposition of firearms from the estate.

Once the Form 4 is prepped by the Executor and the required accompanying documents are included, the buyer then completes their required fields on the Form 4. I have a guide from the buyer’s perspective here. Once the buyer completes their steps, they mail the Form 4, a check for the tax, and all other required documentation, to the ATF.

The ATF will send the approved tax-stamp back to the Executor (at the address entered in 3a) who can then contact the buyer and arrange for the physical transfer.

In the past, I have attempted to assist clients in filing their eForm 1 applications. The sheer volume has made it impossible for me to continue offering that as a free service since it can take over half-an-hour per application to receive the scanned documents, review them for any errors, compress them to comply with ATF requirements, and then navigate the eForms system.

In the past, I have attempted to assist clients in filing their eForm 1 applications. The sheer volume has made it impossible for me to continue offering that as a free service since it can take over half-an-hour per application to receive the scanned documents, review them for any errors, compress them to comply with ATF requirements, and then navigate the eForms system.