This is a questions that I am often asked and the answer is “Yes it can!” But that is only the beginning of the discussion.

The follow-up questions that you should be asking (and the respective answers) are:

1) Should I put my car in just any trust?

No. In order to maximize the benefits of placing your automobile into a trust you will want one that is properly drafted for the purpose.

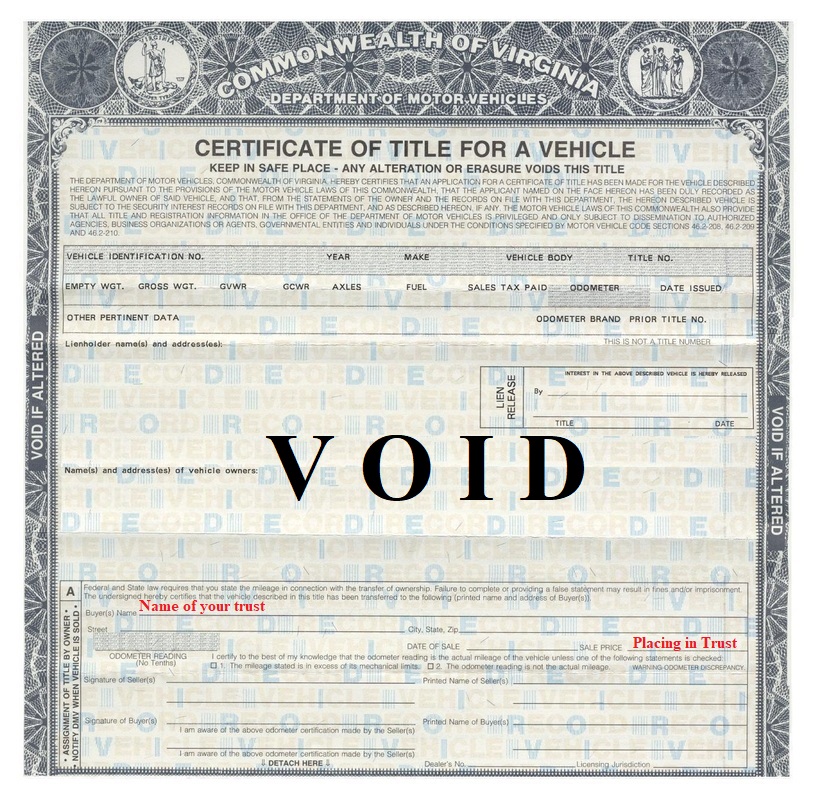

2) How do I transfer an individually-owned automobile into my trust?

You must complete the Assignment of Title by Owner section on the existing title. You will place the trust name in the buyer field and the phrase ‘Placing in Trust‘ in the Sale Price field (see example below).

You will then need to complete the Application for Certificate of Title and Registration (VSA 17A) in the name of the trust in your capacity as Trustee.

Make sure that you select ‘Owned by an Individual’ on the second row (assuming the vehicle is not actually used for business purposes).

![]()

You will then take the your trust instrument, title with completed assignment section, and application to your nearest DMV office to complete the process.

3) Do I have to pay use-tax when I transfer an individually owned automobile into my trust?

Not if you have a properly drafted trust.

To transfer the automobile without being subject to use tax you will need to complete a Purchaser’s Statement of Tax Exemption (SUT 3).

In the Statement of Exemption section you will write the following:

Transferred to a trust for which I am a beneficiary

Then, in the paragraph number section below the Statement of Exemption reference paragraph 23.

Important Note: If I didn’t draft your trust then you should consult with the attorney who drafted it to insure that your trust allows you to avail yourself of this Exemption.

4) If my trust owns my automobile, will it qualify for Personal Property Tax Relief (PPTR)?

Yes. Per the Virginia DMV’s guidance, “[A] qualifying vehicle ([as determined by] Va. Code 58.1-3523) is determined by the Commissioner of the Revenue (COR) of the county, city or town where the vehicle is garaged. In order to qualify for the tax relief, the motor vehicle must be owned or leased by a natural person or held in private trust and be used for nonbusiness purposes.”

That is why your answer to the checkbox on the VSA 17A above is so important

5) Is there anything else I need to do when I transfer my automobile into a trust?

Yes. Do not forget to contact your insurance provider. By federal law the insurance itself will not change but your policy needs to reflect the new ‘owner’ of the automobile.

Please contact me if you would like to discuss the estate planning and privacy benefits of having a living trust hold your automobiles.