On April 20, 2023, the United States District Court for the District of Columbia issued a disappointing ruling in the case of Hanson v District of Columbia.

On April 20, 2023, the United States District Court for the District of Columbia issued a disappointing ruling in the case of Hanson v District of Columbia.

Hanson concerned DC’s limit on magazine capacity and was a case that many in the legal community, myself included, considered to be a likely pro-gun win given the strong Second Amendment protections recently laid out by the Supreme Court in the case of New York State Rifle & Pistol Assn, Inc. v. Bruen.

The court engaged in what I consider to be convoluted semantic gymnastics to avoid invalidating DC’s ban on standard capacity magazines. While acknowledging that standard capacity magazines are in ‘common use’ (Heller II noted that “fully 18 percent of all firearms owned by civilians in 1994 were equipped with magazines holding more than ten rounds, and approximately 4.7 million more such magazines were imported into the United States between 1995 and 2000.”), the court in Hanson astonishingly ruled that they are not particularly suitable for civilian self-defense and therefore not protected by the Second Amendment.

Specifically, the court stated that:

In conclusion, the Court finds that the Second Amendment does not cover LCMs because they are not typically possessed for self-defense. LCMs fall outside of the Second Amendment’s scope because they are most useful in military service and because they are not in fact commonly used for self-defense.

In my opinion, this ruling (see below for the full opinion) directly contradicts the holdings from Heller, Heller II, and Bruen. Those of us who felt that Bruen would ensure that the Second Amendment would cease being treated as a second-class right should take note that the struggle for meaningful recognition is far from over.

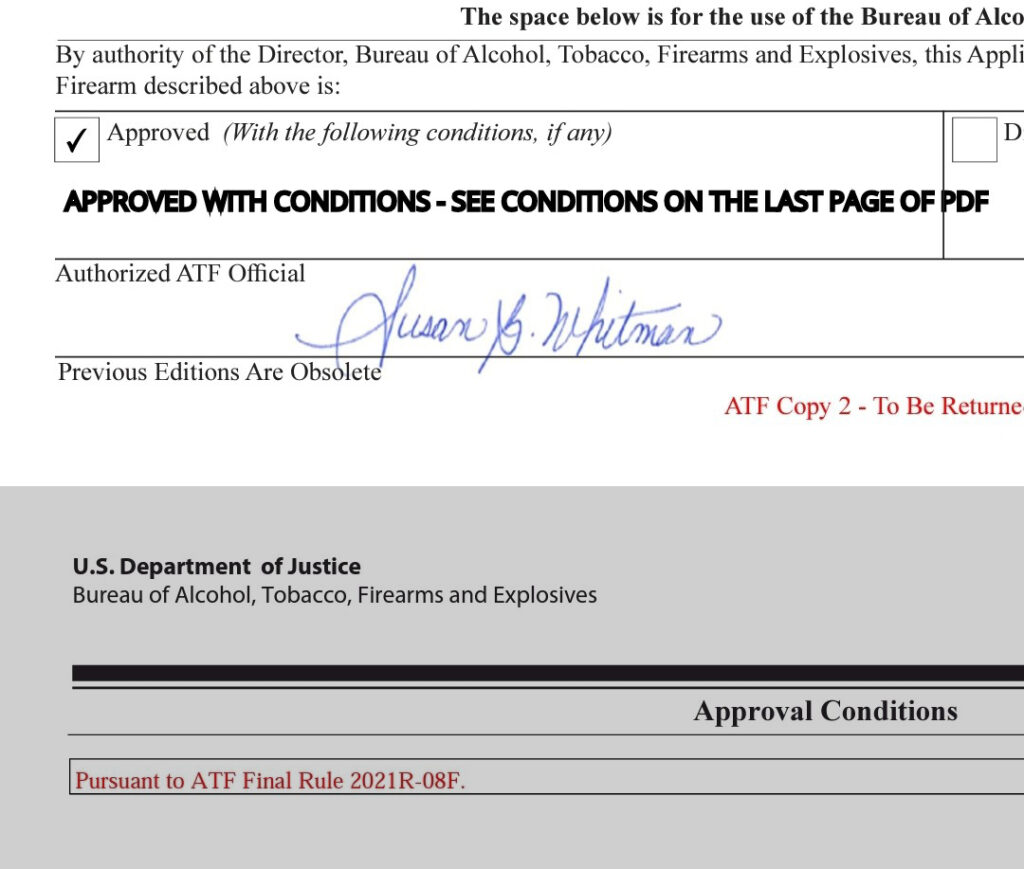

During one of the virtual training sessions the ATF held earlier this week, one of the presenters made a statement that I think bears repeating. While it isn’t 100% perfect, I think it can help eliminate some of the misunderstandings that are rampant in the community right now.

During one of the virtual training sessions the ATF held earlier this week, one of the presenters made a statement that I think bears repeating. While it isn’t 100% perfect, I think it can help eliminate some of the misunderstandings that are rampant in the community right now.